Why Chief Market Officers should prioritise their payment strategy Part IV

29 / 09 / 2022

If your payment strategy isn’t a top priority, you could be leaving money on the table. In this series, we explore some of the key benefits businesses could enjoy by examining the role of payments in their customer experience framework.

Part IV - Omnichannel and the rise of live social selling

More than ever, Australians are shopping online, spending on average 4.4 hours per week browsing and buying, according to respondents of Finder’s Consumer Sentiment Tracker 2021.

However, while online shopping continues to gain popularity, retailers shouldn’t discount the importance of bricks and mortar shops to their bottom line – consumers may still prefer to touch and try before they buy.

Omnichannel: Blending the best of both worlds

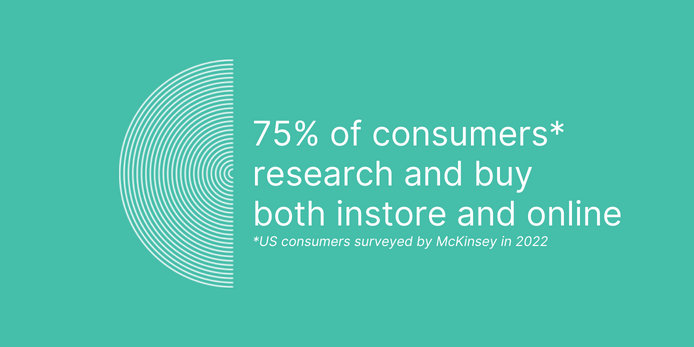

A US survey conducted in 2022 found that three quarters of consumers surveyed browse products online but bought them both online and instore – indicating how important an omnichannel experience is for buyers. A 2021 study conducted by Monash Business School’s Australian Consumer and Retail Studies found that there’s an even split amongst survey respondents – 50% preferred shopping instore while 50% preferred online as their main purchase channel.

Many retailers are designing-in the flexibility for their customers to shop and pay the way they want – whether instore, online or a mixture of both. Omnichannel allows for personalised customer journeys that instore or online alone couldn’t provide.

Click and collect. Post-pandemic, click and collect has become a household name. Powered by omnichannel, click and collect is the ability for your customers to purchase on your website or app, and physically pick up their goods at brick and mortar shop.

Click and return. Taking the concept one step further, what about enabling a customer to return their item by lodging their return online and dropping it in the mail instead of driving to the store to return it? Offering a click and return capability not only gives your customers more flexibility for returning their goods, it gives your business the option to return goods to a central location for redistribution.

Shop instore, pay in-app. Perhaps you know your customers are tech savvy, don’t want to feel “rushed” by the presence of staff, and prefer to control their own shopping journey. Consider building an app that a customer can download, use to scan goods, build out a shopping cart and process their payment – all without staff interaction.

Alternatively, self-serve kiosks can provide another option for customers that like to shop on their own. With built-in scanners and payment acceptance facilities, kiosks can provide a complimentary checkout option for customers who want to skip the queue.

Get social - the rise in social eCommerce and live social selling

Social media remains a key channel for marketing and selling, with an estimated value of global social commerce sales projected to reach $2.9 trillion by 2026. In 2020, 28% of all internet users in Australia made purchases on social media. However, the approach is slowly changing from traditional organic and sponsored posts to encourage clicks.

How live social selling works and how to get started

Live social selling has emerged as a leading strategy for businesses to showcase their offer in a humanised and approachable way. By hosting live streaming sessions on social media sites like Facebook, Instagram and LinkedIn, businesses (or by proxy through influencers) provide a platform to engage directly to their community of followers and prospects.

There are many ways to structure a live social selling event – from unboxing’s, to How-To tutorials using a product, even to leveraging sponsorship opportunities. The key is to include opportunities for engagement and strong Calls-to-Action throughout.

For example, if your company sells sporting equipment and regularly sponsor an event, you could work with one of the athletes to live stream a game on their social media channel. During the live stream, you could embed links back to the product pages on your website, engage with comments in real-time and offer exclusive deals to live stream viewers with unique discount codes.

Read the rest of our series “Why Chief Market Officers should prioritise their payment strategy” below:

Part I - Repositioning the role of payments in your sales cycle

Part II – Redesign your instore experience by taking payments to the customer

Part III – Getting the most out of your eCommerce platforms

ANZ Worldline Payment Solutions provides payment technologies that can benefit Australian businesses.

To find out more about how we can help bring your customer payment experience to life, get in touch today.

ANZ Worldline Payment Solutions means Worldline Australia Pty Ltd ACN 645 073 034 (“Worldline”), a provider of merchant solutions. Worldline is not an authorised deposit taking institution (ADI) and entry into any agreement with Worldline is neither a deposit nor liability of Australia and New Zealand Banking Group Limited ACN 005 357 522 (“ANZ”) or any of its related bodies corporate (together “ANZ Group”). Neither ANZ nor any other member of the ANZ Group stands behind or guarantees Worldline.