Merchant Statements

A guide on how to read your statements

Thanks for choosing ANZ Worldline Payment Solutions for your merchant services. The guides below have been created to help you understand the Statements and Notices you receive from us every month.

We have two setttlement options - Net or Gross. Please read the guides that are relevant to your business.

Net Settlement Statements

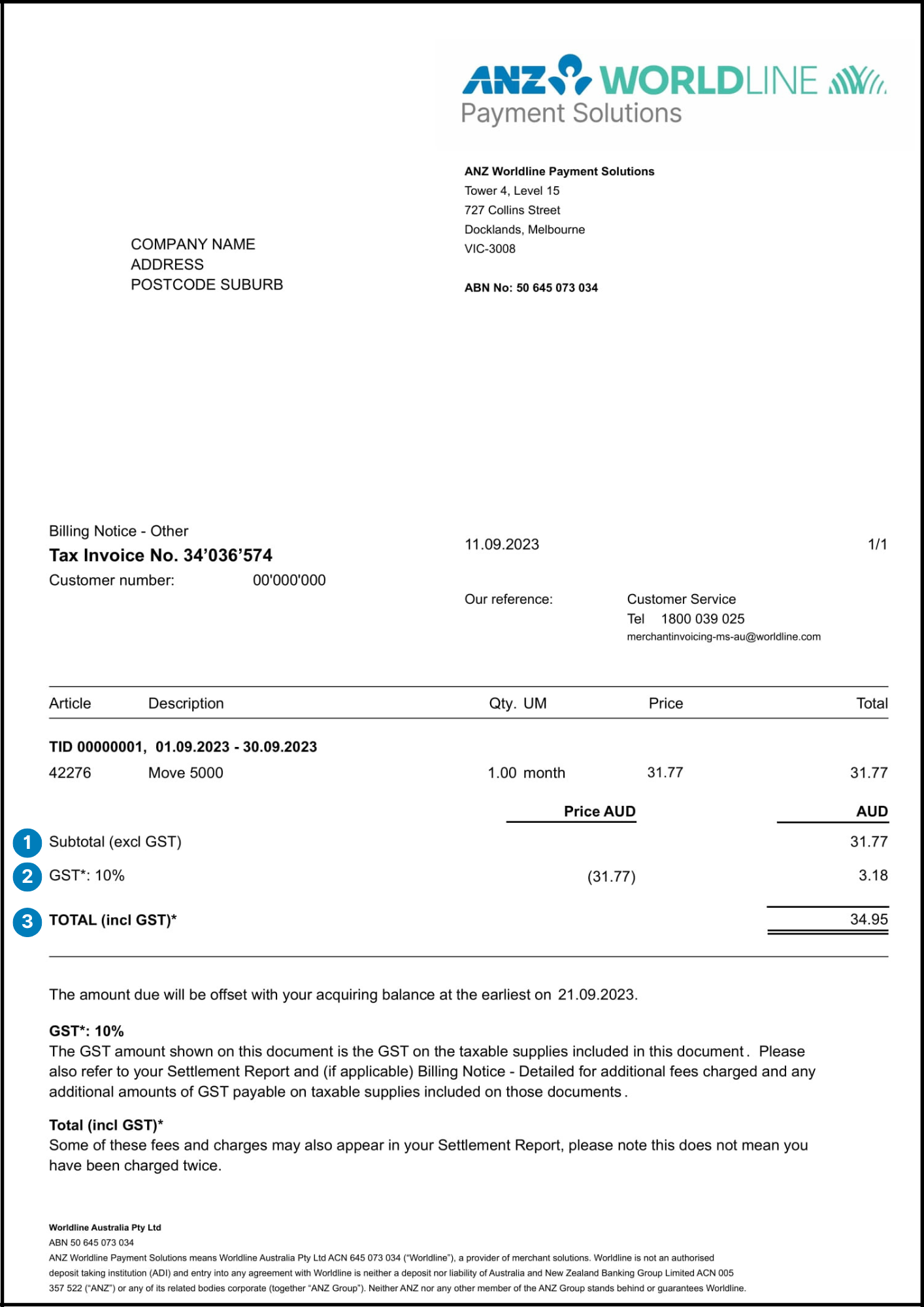

The 'Billing Notice - Other' shows a breakdown of Other fees, charges and adjustments which can include:

- • Terminal Rental Fees

- • Integration Fees

- • Tap on Mobile Additional User Fees

- • Tap on Mobile Subscription Fee

- • Worldline Global Online Pay Subscription Fees

- • Hardware costs

You'll receive this on the 10th day of every month (or next business day in the case of a weekend or public holiday) via email, in advance of us debiting your account for your monthly fees at the end of each month.

1. Subtotal (excl GST)

The amount you have been charged for the fees and charges listed on this statement (excl GST).

2. GST*

The amount of GST you have been charged for the fees and charges listed on this statement.

3. Total (incl GST)*

The amount you have been charged on this statement, inclusive of GST.

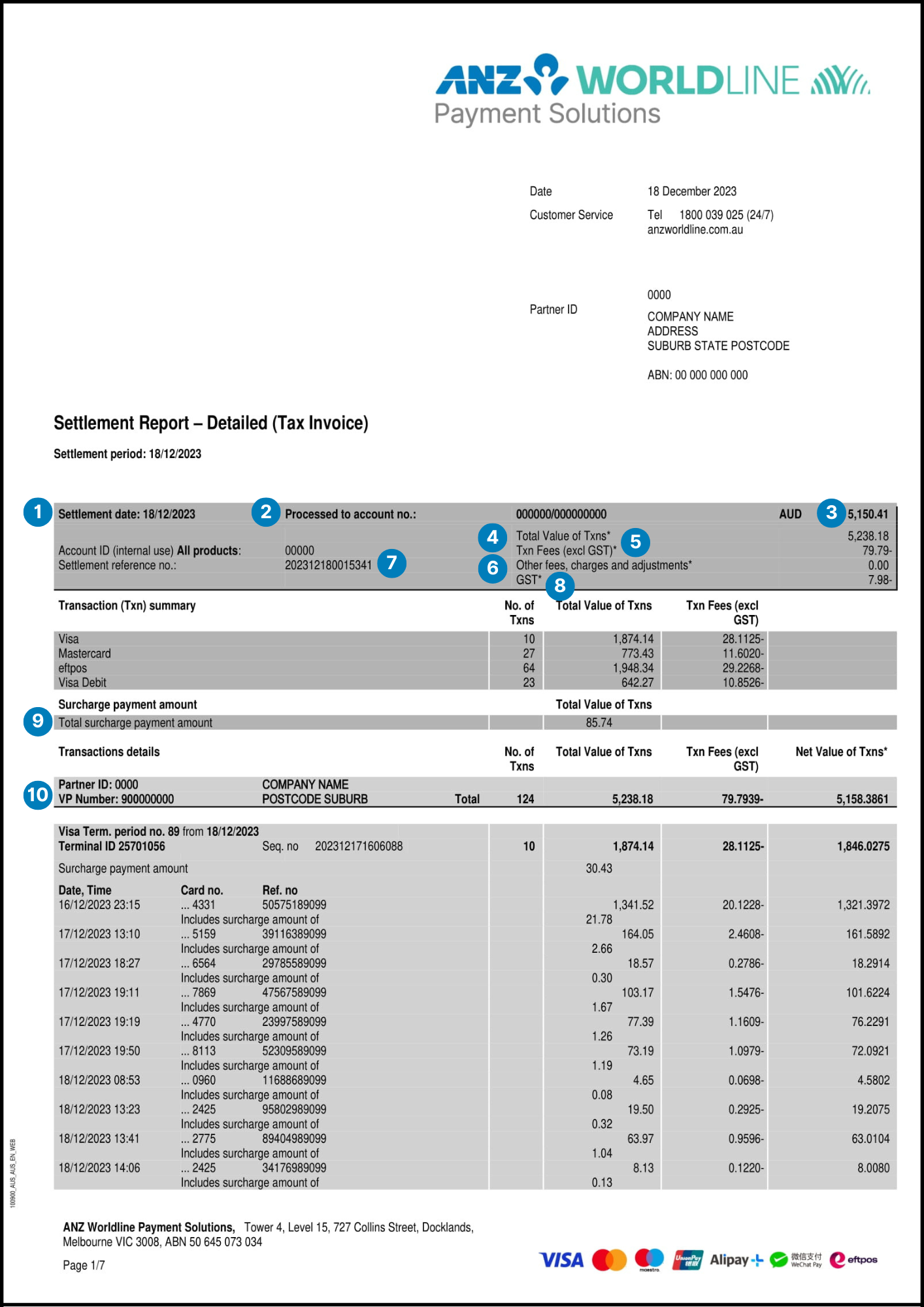

Your ‘Settlement Report - Detailed’ provides you with a summary of the settlement that was processed into your nominated bank account. In addition to this, it will provide you with a breakdown of the transactions processed during the settlement period.

1. Settlement date

This indicates the date the settlement was processed.

2. Processed to account no.

The bank account number we settled to.

3. Total settlement amount

This represents the amount settled into your bank account for the listed settlement period.

4. Total Value of Txns (inc GST)

This denotes the total value of transactions you processed during the settlement period.

5. Txn Fees (excl GST)

The total transaction fees you were charged for the transactions processed for the listed settlement period. Note: This line item also includes the crediting and debiting of any DCC rebates and DCC rebate reversals, if appliable.

6. Settlement reference number

You can search this number in your Merchant Portal and generate a report to view the breakdown of the transactions making up the settlement amount.

7.Other fees, charges and adjustments incl. GST

A total sum of all Other fees, charges and adjustments that attract GST. This amount can include Terminal Rental Fees.

8. Other fees, charges and adjustments excl. GST

A total sum of all Other fees, charges and adjustments that do not attract GST. Some of these fees and charges may also appear in your Billing Notice - Other. Note: This does not mean you have been charged twice.

9. GST

How do I calculate the total GST my business has been charged this billing period?

To calculate the full amount of GST charged for your billing period, please add the number you see here with the GST line item listed in your Billing Notice – Other.

10. Total surcharge payment amount

The total amount of surcharge that was processed during the settlement period.

11. Terminal ID

This section breaks down all transactions for the settlement period by Terminal ID and card scheme.

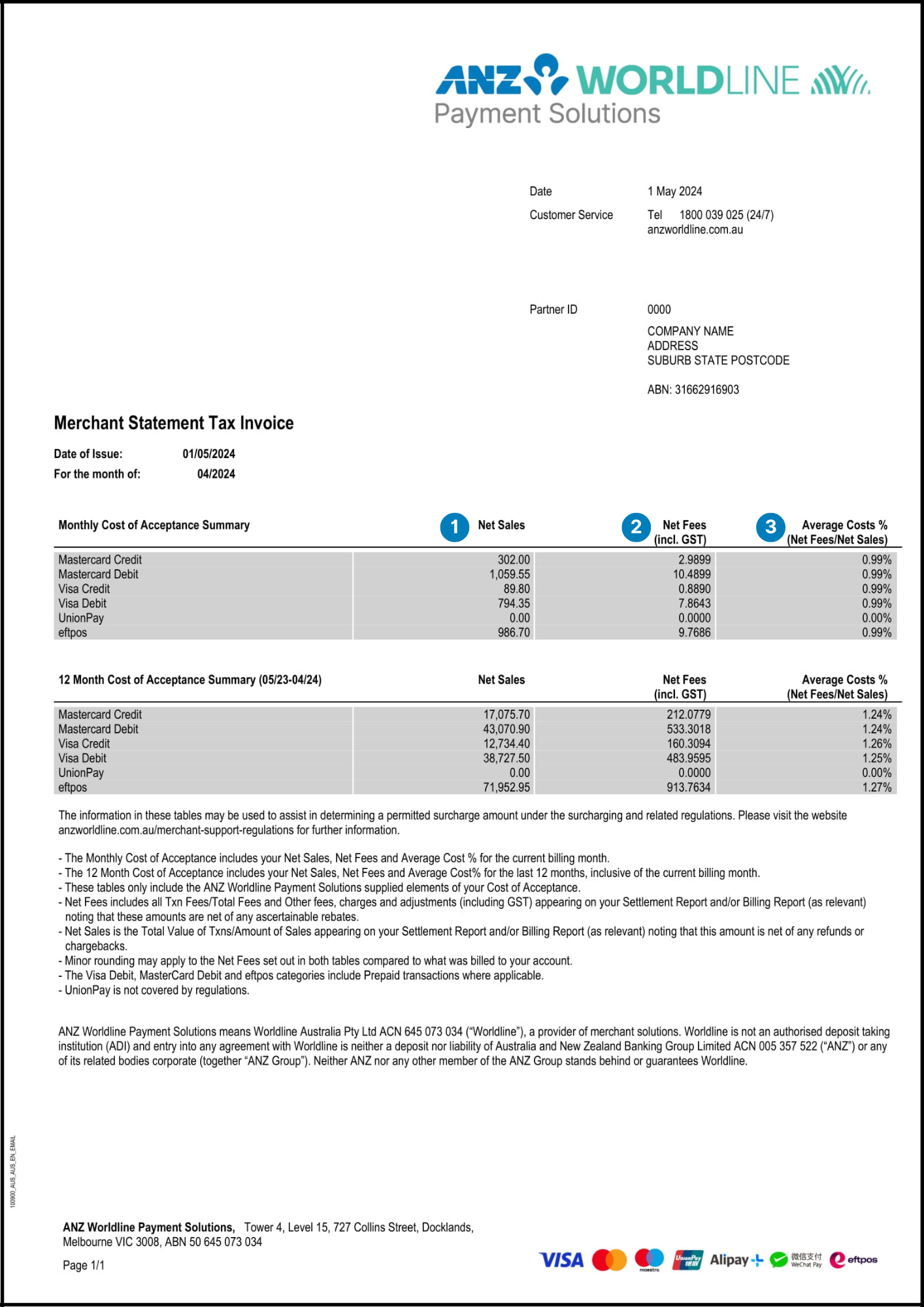

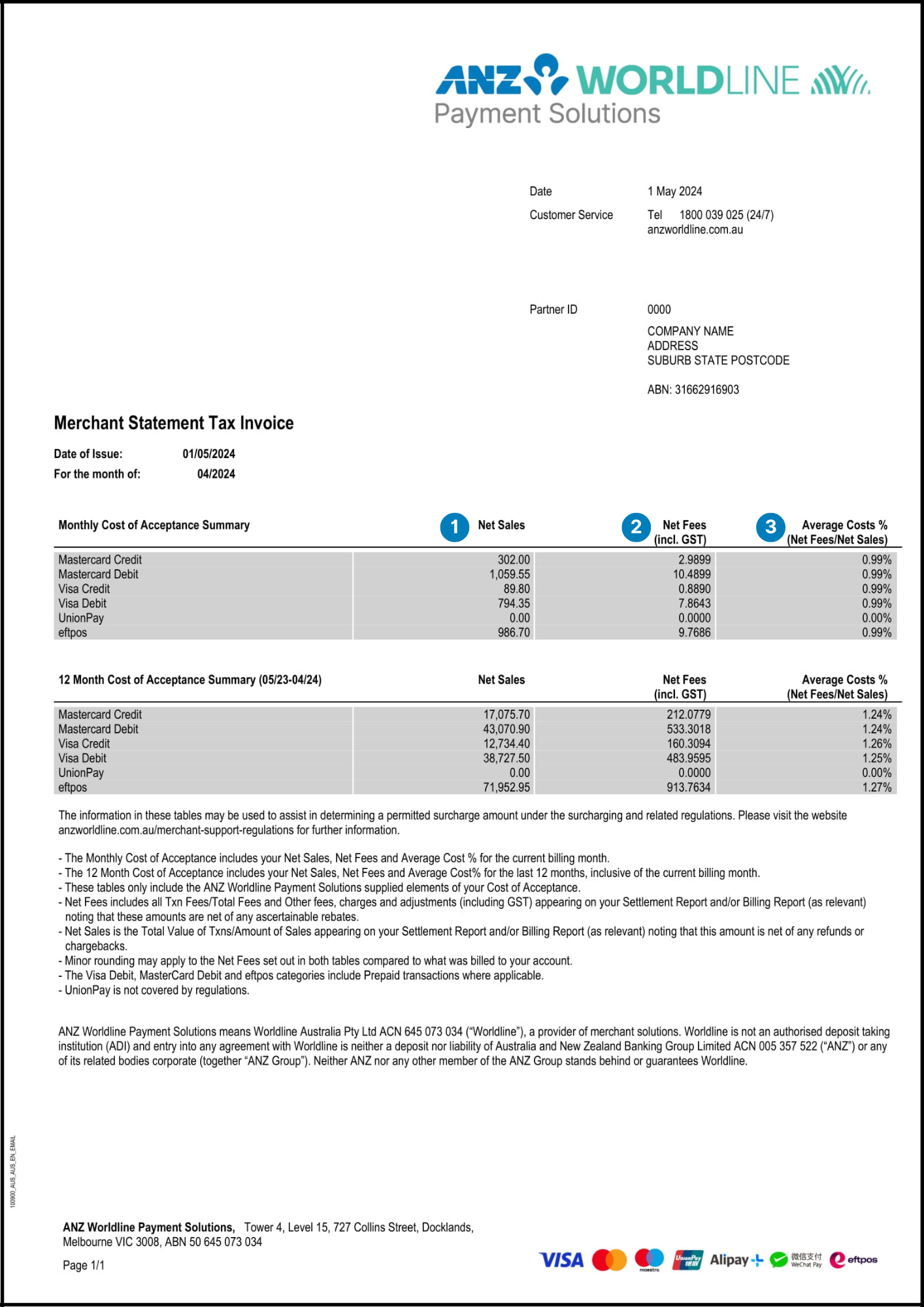

Your ‘Cost of Acceptance’ report contains two tables that outline the fees you incur for processing card payments. In addition to transaction fees, this report considers ANZ Worldline Payment Solutions’ fees and charges you incur for accepting card payments (e.g. terminal rental fees). The first table shows the ANZ Worldline Payment Solutions elements of your cost of accepting card payments per card type for the previous month, while the second displays the ANZ Worldline Payment Solutions elements of your rolling 12 month average cost of accepting card payments per card type.

If you decide to apply a surcharge to your customers, you can use this report to help determine a suitable rate to surcharge for each card type. Please ensure the surcharge applied doesn’t exceed your overall cost of acceptance for that card type.

For more information about surcharging and cost of acceptance, please visit the following link:

anzworldline.com.au/merchant-support-regulations

1. Net Sales

The total value of transactions processed through your the ANZ Worldline Payment Solutions’ merchant facility for the relevant period. Any refunds and chargebacks have been deducted.

2. Net Fees

The total fees charged by ANZ Worldline Payment Solutions for the relevant period, net of any ascertainable rebates.

3. Average Cost %

To calculate your Average Cost %, we divide the Net Fees by the Net Sales. This percentage gives you the ANZ Worldline Payment Solutions elements of your cost of accepting card payments for each card type listed in the table.

Gross Settlement Statements

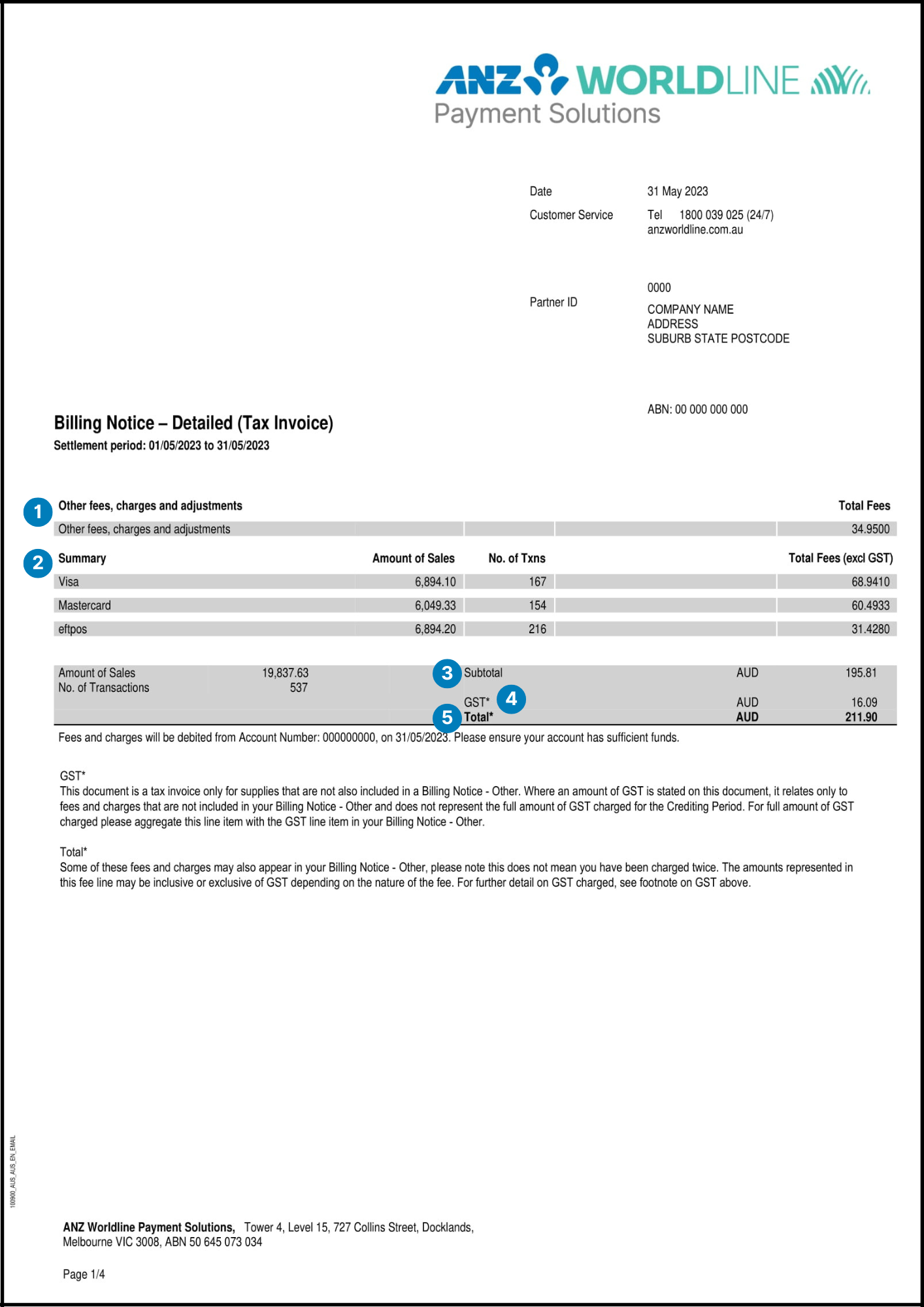

The 'Billing Notice - Detailed' provides a summary of your transaction fees broken down by scheme and card type. In addition to this, it also includes charges for your Merchant Facility i.e. Terminal Rental, integration fees, etc. You'll receive this document on a monthly basis via email but can also access it in your Merchant Portal.

1. Other fees, charges and adjustments incl. GST*

The total sum of all other fees, charges and adjustments, including those that appear on your Billing Notice - Other. This amount can include Terminal Rental Fees.

2. Other fees, charges and adjustments excl. GST*

A total sum of all other fees, charges and adjustments that do not attract GST.

3. Summary

This table shows the total amount of sales, number of transactions processed, and the total transaction fees including Merchant Service Fees (MSF) or Debit Card Fees (DCF) for each card scheme. The Total Fees listed here exclude GST. Note: The total transaction fees also include the crediting and debiting of any DCC Rebates and DCC Rebate reversals, if applicable.

4. Subtotal

The sum of Total Fees from ‘Summary’ (ex GST) and Total Fees from ‘Other fees, charges and adjustments’.

5. GST*

How do I calculate the total GST my business has been charged this billing period?

To calculate the full amount of GST charged for your billing period, please add the number you see here with the GST line item listed in your Billing Notice – Other.

6. Total*

The total fees and charges you've been billed for the month.

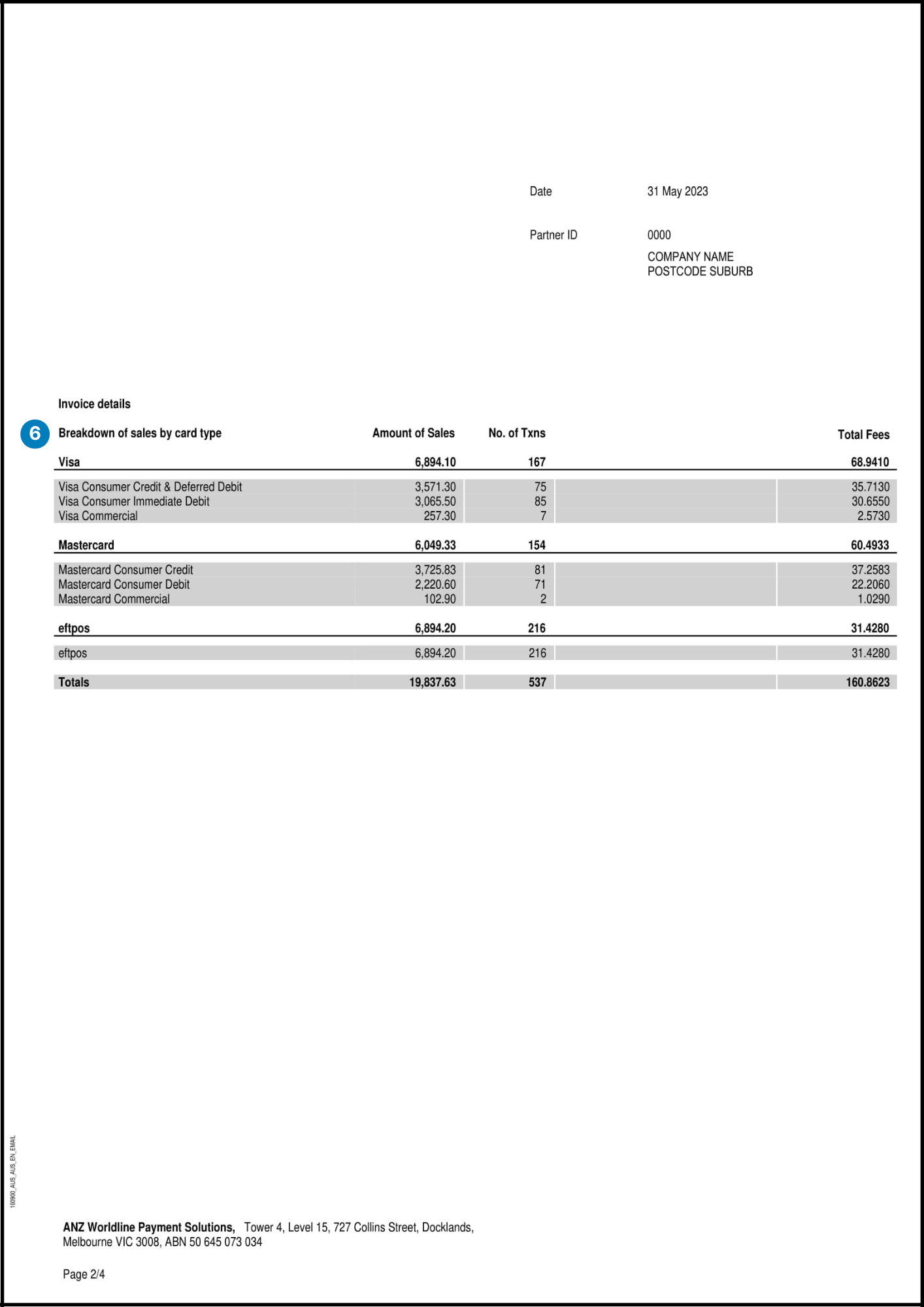

7. Breakdown of sales by card type

A detailed breakdown of the sales processed, by card type / scheme.

The total fees listed here exclude GST.

8. Amount of Sales

The total amount of sales that have been processed.

9. No. of Txns

The total number of transactions that have been processed.

10. Per Item Fee

The Merchant Service Fee (MSF) or Debit Card Fee (DCF) ANZ Worldline Payment Solutions are charging you to process transactions for the relevant card scheme.

11. Total Fees

The total amount of fees charged (excl GST). Note: The Total Fees also include the crediting and debiting of any DCC rebates and DCC rebate reversals, if applicable.

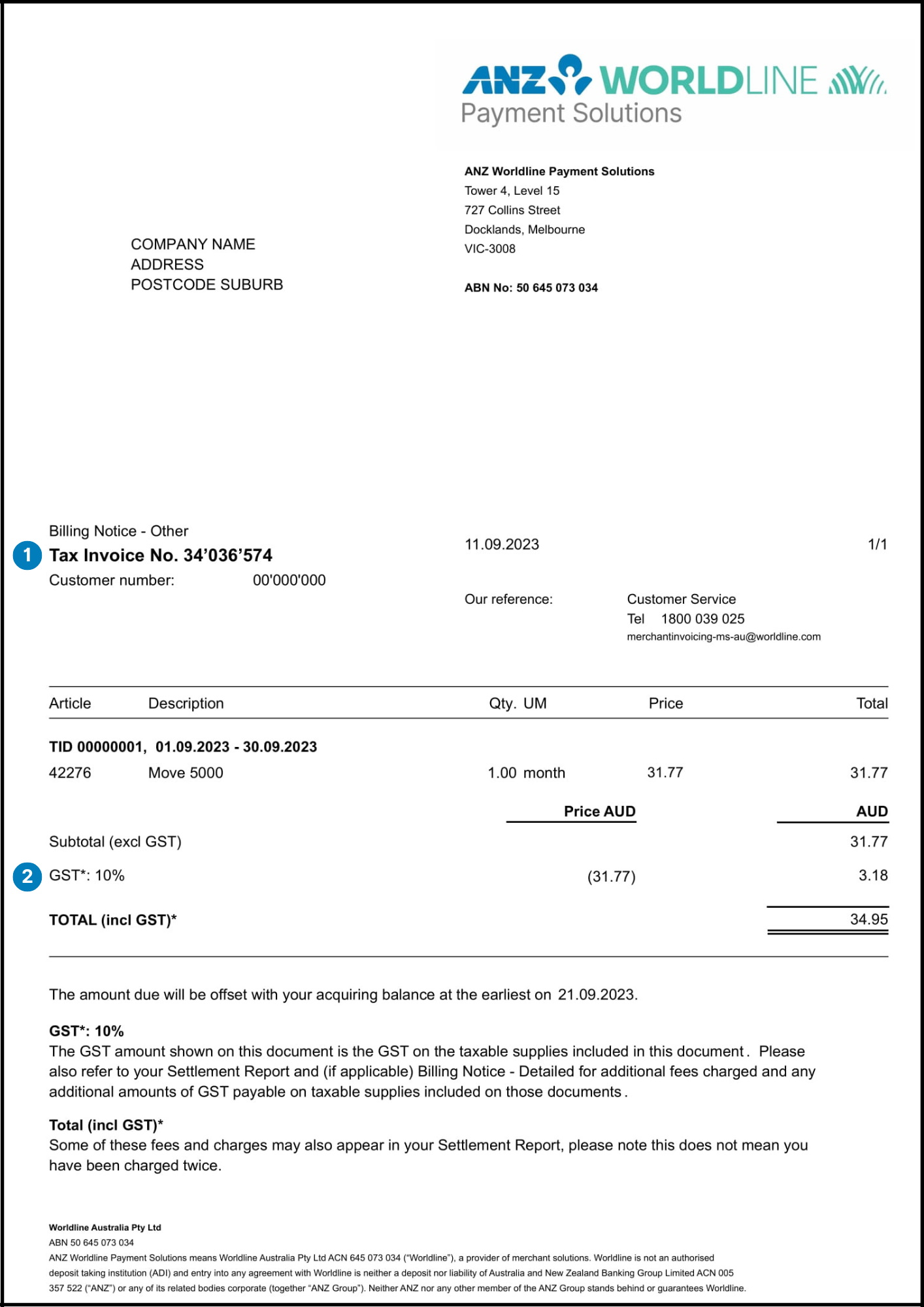

The 'Billing Notice - Other' shows a breakdown of Other fees, charges and adjustments which can include:

- • Terminal Rental Fees

- • Integration Fees

- • Tap on Mobile Additional User Fees

- • Tap on Mobile Subscription Fee

- • Worldline Global Online Pay Subscription Fees

- • Hardware costs

You'll receive this on the 10th day of every month (or next business day in the case of a weekend or public holiday) via email, in advance of us debiting your account for your monthly fees at the end of each month.

1. Tax Invoice Number

The Tax Invoice Number matches the invoice number listed on your Billing Notice – Detailed statement (Reference 11).

2. GST

The amount of GST you have been charged for the fees and charges listed on this statement. Please note this isn’t the total amount of GST you have been charged for the period. To calculate the full amount of GST charged for your billing period, please add the number you see here with the GST line item listed in your Billing Notice – Detailed. (Referenced as Point 4).

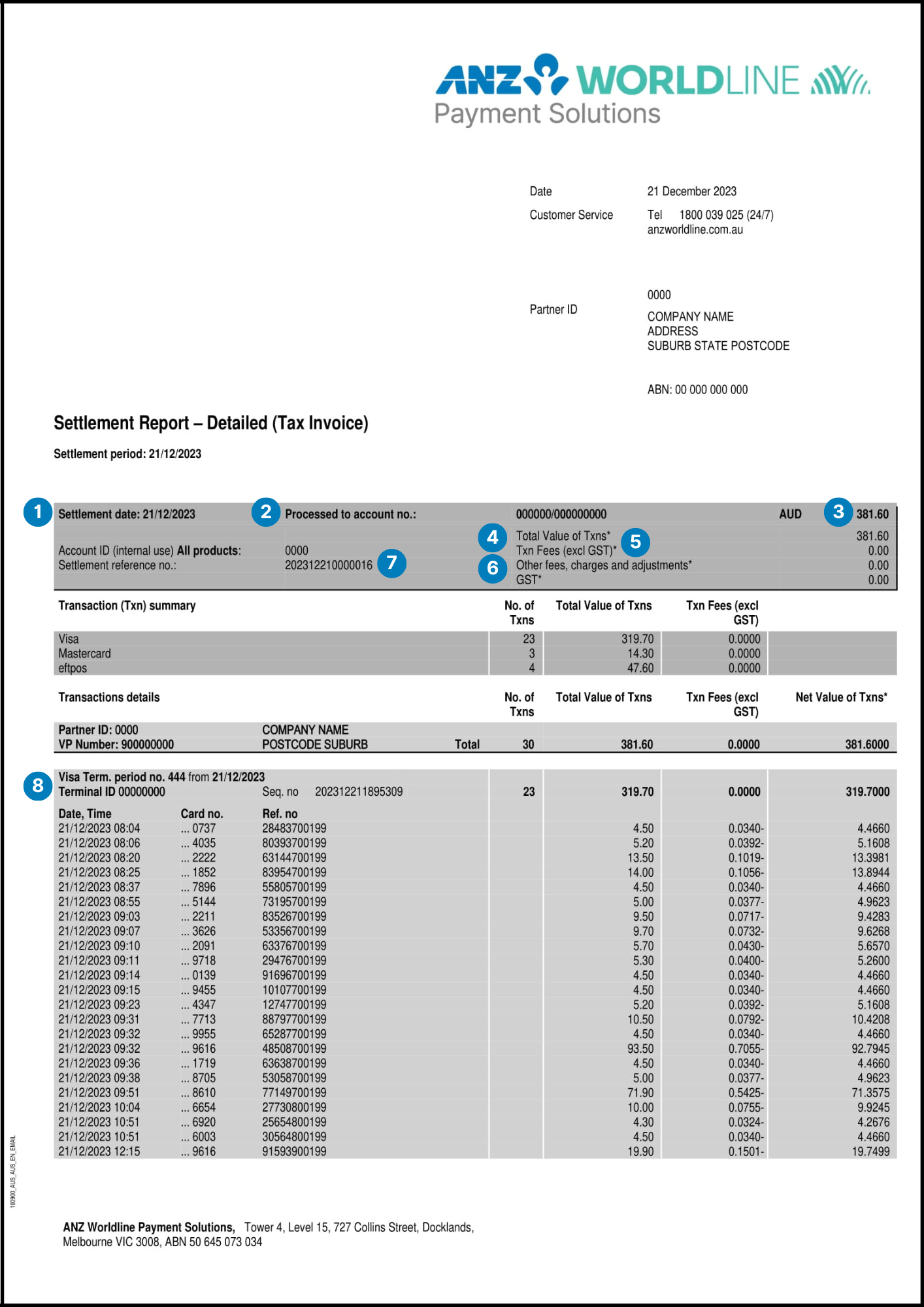

Your ‘Settlement Report - Detailed’ provides you with a summary of the settlement that was processed into your nominated bank account. In addition to this, it will provide you with a breakdown of the transactions processed during the settlement period.

1. Settlement date

This indicates the date the settlement was processed.

2. Processed to account no.

The bank account number we settled to.

3. Total settlement amount (gross)

The amount settled into your bank account for the settlement period listed on the statement.

4. Total Value of Txns (inc GST)

This denotes the total value of transactions you processed during the settlement period.

5. Txn Fees (excl GST)

This line will appear as $0 as your fees are charged to you at the end of the month. The details of these fees and charges can be found in your Billing Notice - Detailed.

6. Other fees, charges and adjustments

This also appears as $0 as your fees will be charged at the end of the month. For specific details on these fees and charges, refer to your ‘Billing Notice – Detailed’ and ‘Billing Notice – Other’.

7. Settlement reference number

You can search this number in your Merchant Portal and generate a report to view the breakdown of the transactions making up the settlement amount.

8. Terminal ID

This section breaks down all transactions for the settlement period by Terminal ID and card scheme.

Your ‘Cost of Acceptance’ report contains two tables that outline the fees you incur for processing card payments. In addition to transaction fees, this report considers ANZ Worldline Payment Solutions’ fees and charges you incur for accepting card payments (e.g. terminal rental fees). The first table shows the ANZ Worldline Payment Solutions elements of your cost of accepting card payments per card type for the previous month, while the second displays the ANZ Worldline Payment Solutions elements of your rolling 12 month average cost of accepting card payments per card type.

If you decide to apply a surcharge to your customers, you can use this report to help determine a suitable rate to surcharge for each card type. Please ensure the surcharge applied doesn’t exceed your overall cost of acceptance for that card type.

For more information about surcharging and cost of acceptance, please visit the following link:

anzworldline.com.au/merchant-support-regulations

1. Net Sales

The total value of transactions processed through your the ANZ Worldline Payment Solutions’ merchant facility for the relevant period. Any refunds and chargebacks have been deducted.

2. Net Fees

The total fees charged by ANZ Worldline Payment Solutions for the relevant period, net of any ascertainable rebates.

3. Average Cost %

To calculate your Average Cost %, we divide the Net Fees by the Net Sales. This percentage gives you the ANZ Worldline Payment Solutions elements of your cost of accepting card payments for each card type listed in the table.